1

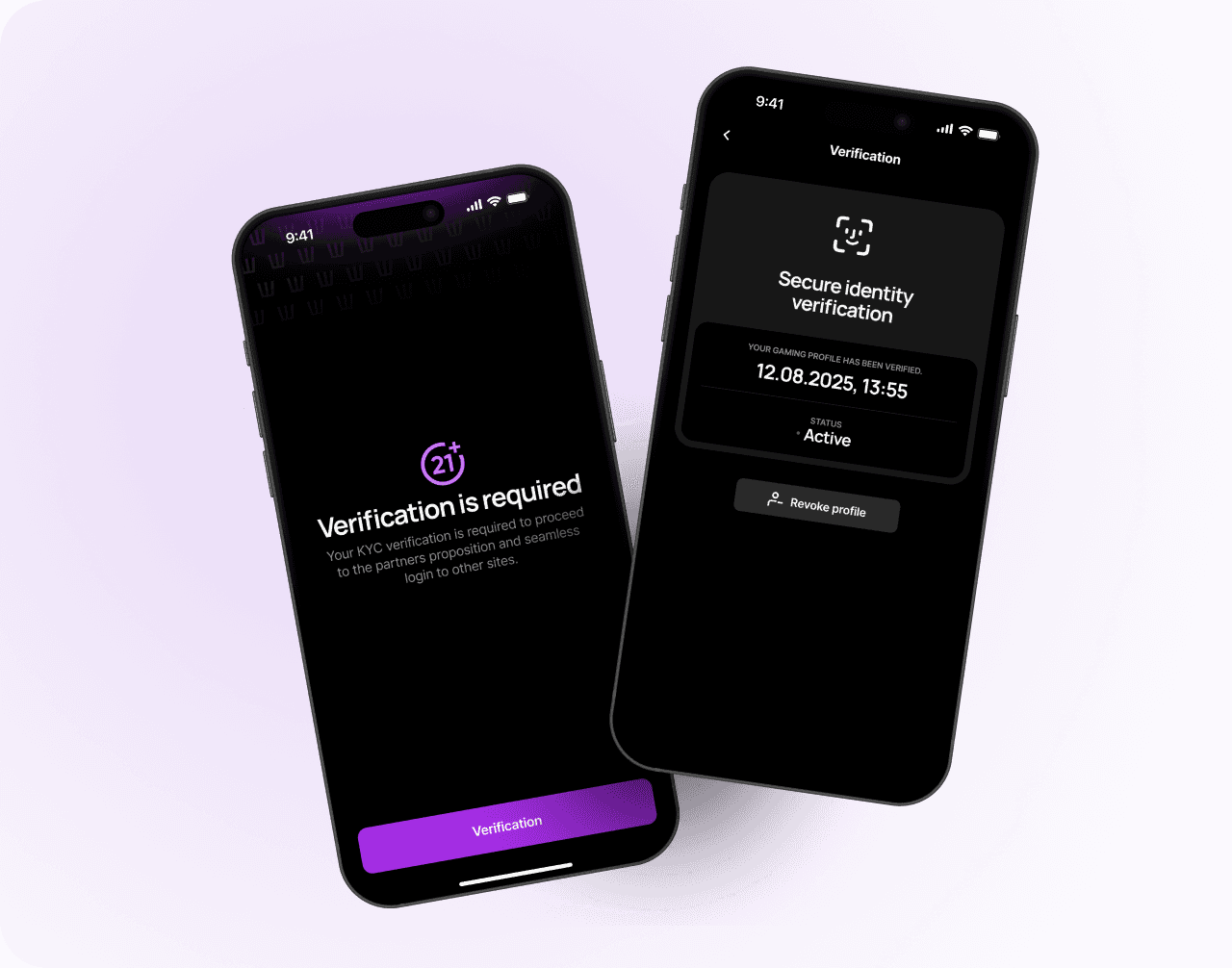

The user completes a one-time KYC verification through a certified provider.

2

WinPass creates an encrypted identity token confirming verification status.

3

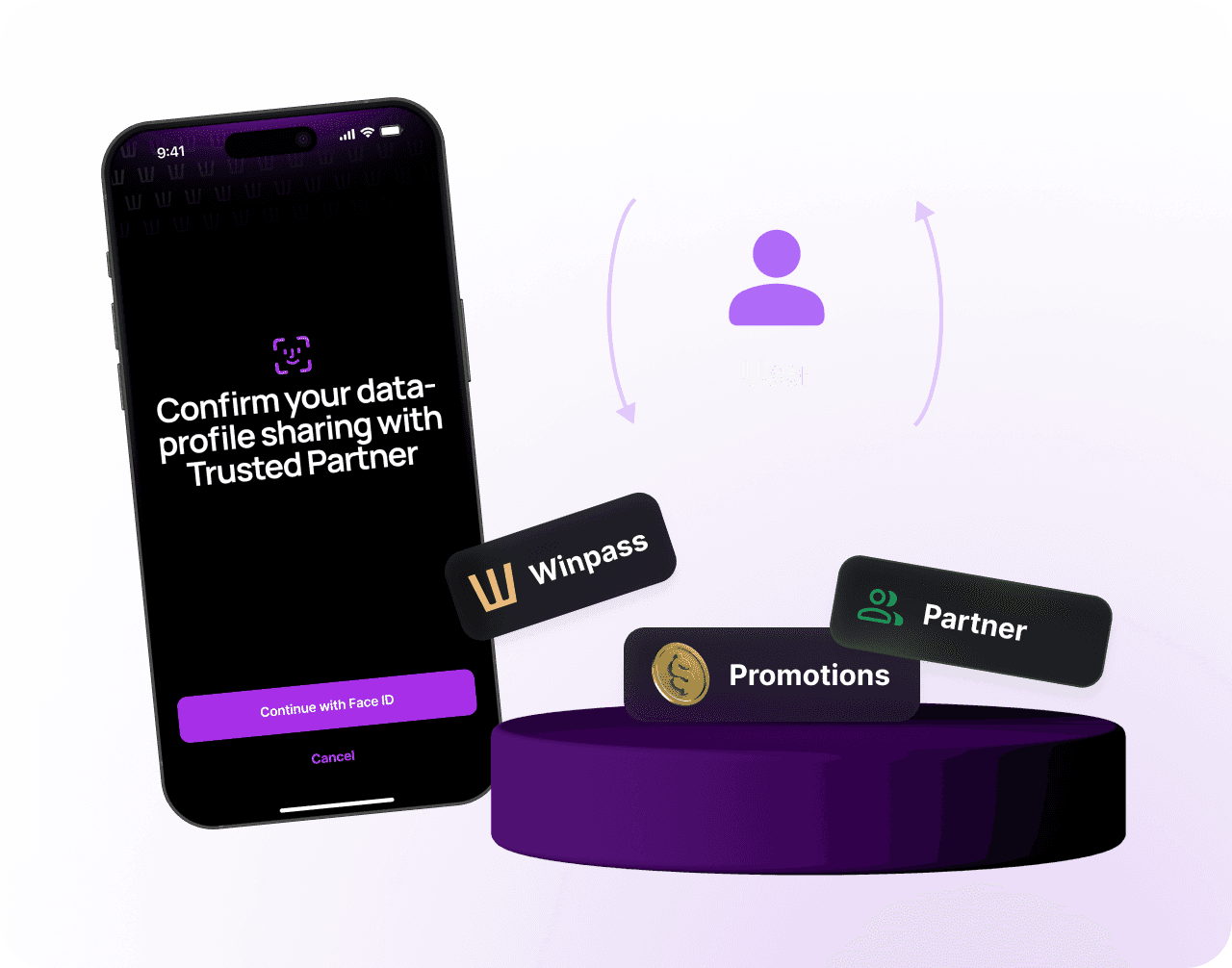

When accessing a partner website, only the verified result is shared — never the personal data itself.

4

The user gets instant access and, if applicable, a personalized experience or bonus from the partner.

Regulatory-Ready

Privacy-First

Data Minimization

Only essential information is shared for authorization.

End-to-End Encryption

All transmissions are secured to financial-industry standards.

AML, and KYC Ready

Fully compatible with international and local regulations.

Local Integration

WinPass nodes operate in-country, integrating with national KYC providers and authorities when required.

Financial services

Banks, fintech apps, investment platforms

User

Convenience

Sharing services

For Partners:

For Regulators:

General Inquiries:

Address:

© 2025 WinPass Technologies. All rights reserved.